Apple and Samsung are thinking about buying Intel

30.10.24

The potential purchase of Intel by Samsung and Apple could significantly change the market for microchips and mobile devices. In the face of increasing competition in the field of smartphone chipsets, both companies are looking to improve their technologies and develop thinner and more powerful devices.

Acquiring Intel would allow Apple and Samsung to control chipset manufacturing, reducing reliance on third-party manufacturers such as TSMC and Qualcomm. This can lead to stable supply, improved quality and improved interoperability between processors and other device components.

For Apple, this means the ability to build its own cellular modems and improve integration with the A- and M-series processors, which will improve energy efficiency and performance. In turn, Samsung will be able to improve its Exynos chipsets, which will help eliminate criticism about their performance compared to Qualcomm’s solutions.

However, such deals may face regulatory hurdles as they may raise concerns about market monopolization. If the deals go through, it could significantly change the balance of power in the semiconductor market and strengthen the positions of both companies in the mobile device industry.

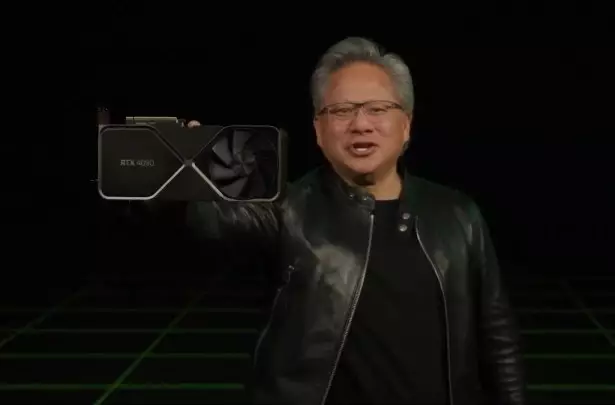

Nvidia CEO, Jensen Huang, has a personal fortune of $109 billion, which is even higher than Intel’s current market capitalization, which is estimated at $96 billion. This reflects the deep crisis that Intel has faced, with its market value falling from $290 billion in 2020 to the current level, accompanied by a 60% decline in shares. Intel has suspended its dividend, cut thousands of jobs and is revising its manufacturing strategies, signaling the company’s broader problems. There are rumors about a possible takeover of Intel by other players, for example, Qualcomm.

On the opposite side, Nvidia is showing incredible growth thanks to high demand for its GPUs used in AI and high-performance computing. At the moment, Nvidia even became the most expensive company in the world with a capitalization of $3.34 trillion. Despite the recent drop in share price by about 10%, the company is still among the top three global tech giants. Jensen Huang, who owns a significant amount of shares in the company, rose to 11th place on the Forbes list of billionaires.

Don't miss interesting news

Subscribe to our channels and read announcements of high-tech news, tes

Oppo A6 Pro smartphone review: ambitious

Creating new mid-range smartphones is no easy task. Manufacturers have to balance performance, camera capabilities, displays, and the overall cost impact of each component. How the new Oppo A6 Pro balances these factors is discussed in our review.

Oppo Reno 15 5G smartphone review: confident

The Oppo Reno15 smartphone emphasizes design, a high-quality display, versatile cameras, and good battery life. Let’s take a closer look.

Study: Artificial Intelligence uses nuclear weapons in 95% of simulations artificial intelligence war

Researchers at King’s College London conducted a series of military simulations using leading artificial intelligence models. The tests used OpenAI’s GPT-5.2, Anthropic’s Claude Sonnet 4, and Google’s Gemini 3 Flash.

Asus ProArt GoPro Edition laptop for action camera fans has gone on sale in Ukraine action-camera Asus laptop

One of the key features of the Asus ProArt GoPro Edition is the proprietary StoryCube service – the first solution for Windows with support for GoPro cloud storage and 360-degree video.